Release – 8/26/22

Greenshades Online Payroll

New Feature – New Pay Run Type: Adjustment Pay Runs (Initial Rollout)

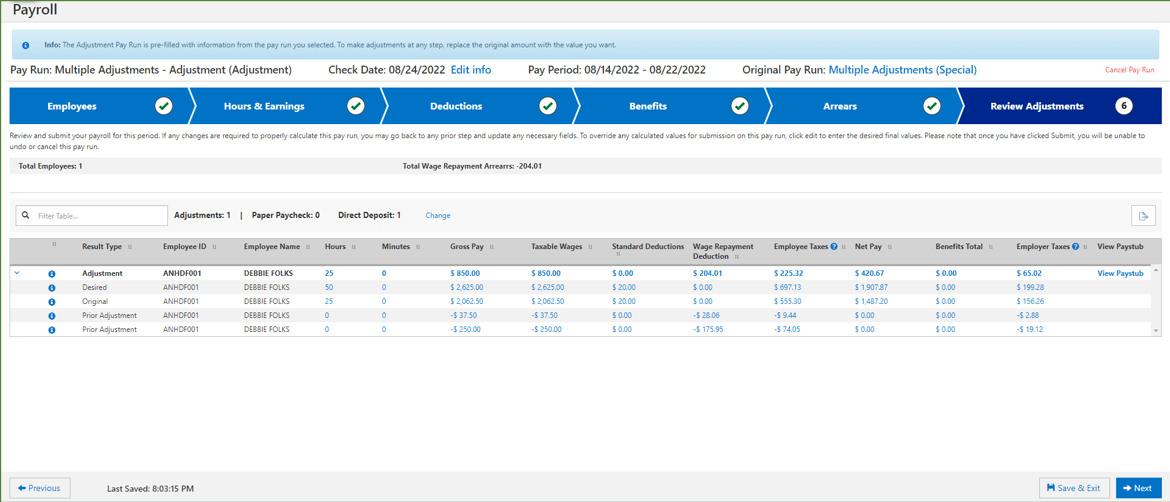

- Feature Description: In the Greenshades online Payroll module, Adjustment Pay Runs are used to remediate mistakes or make changes to the results of an already submitted and processed pay run. Adjustments are a very standard operation for payroll practitioners as payrolls are not always perfect. There are many scenarios and types of mistakes that these practitioners may need to address. The goal of this tool is to provide users a clear and comprehensive way to make these very important, and potentially complex, amendments. The process that Greenshades uses to approach these problems is to allow a user to start by finding their historical pay run that they expect requires changes. The tool will help the user determine if an Adjustment Pay Run is indeed the right avenue for correction. Assuming it is, the tool will create a new pay run that is populated with the inputs of the selected source pay run. At this point, you can imagine the problem being “As a payroll practitioner, I wish that I entered X instead of Y before submitting the original pay run, so that my employees were paid as intended”. As such, the user will be tasked with making changes to the values of the original pay run and turning them into what they wish were entered the first time. After entering these new values, Greenshades’ intelligent pay run calculations will determine the earnings, benefits, deductions, arrears, and tax differences between the original run and this new Adjustment Pay Run. Upon pay run submission, resulting net checks (positive or negative), and future arrearages, will be generated for the affected employees. The most important idea to keep in mind when using this tool is to always remember to enter the values that you “wish” you had in the first place and let Greenshades do the rest.

- Key Feature Information:

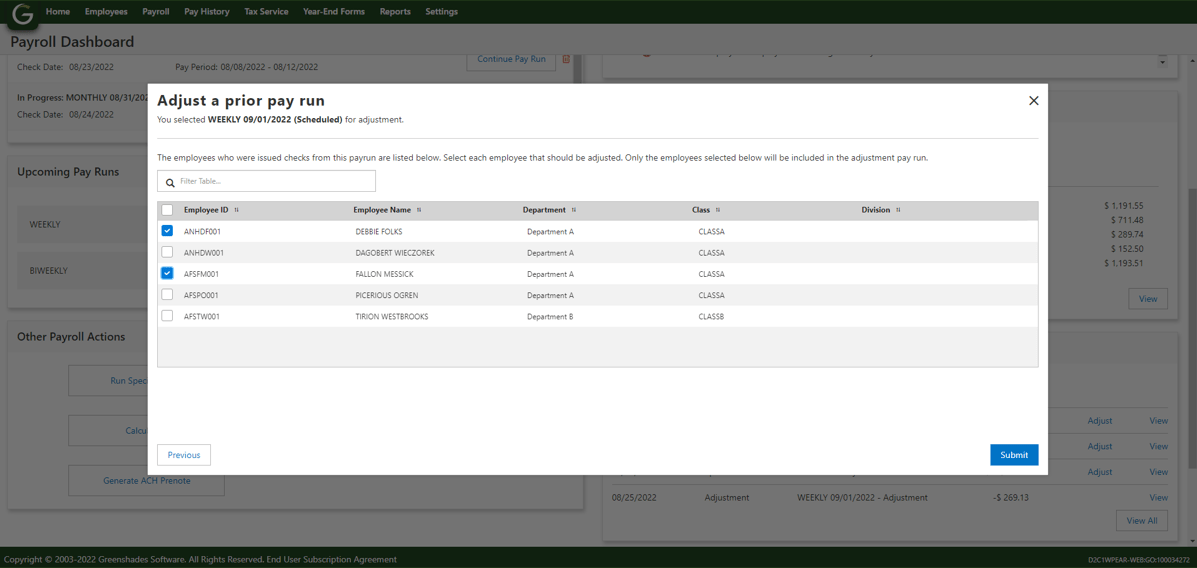

- Employees who were NOT included in the original pay run that you have chosen to adjust, cannot be added to the adjustment run (refer to What this tool is not).

- Tax overrides will NOT be pulled from the original pay run into an Adjustment Pay Run.

- YTD tax auto adjustments are calculated at the time that this amendment pay run is started. This means that if the tax auto adjust may be triggered from amounts that were ‘accrued’ on pay runs that took place afterthe pay run that is being adjusted. The resulting Auto Adjustment will appear on the Adjustment Pay run.

- It is not advisable to pull employees into an Adjustment Pay Run if they do not actually require an adjustment be made. This can cause unintended consequences from recalculations (i.e. Tax override will not be accounted for, tax auto adjustments may trigger, accidental edits could be performed, etc.). Even if there were no resulting changes, and no other issues occurred, those employees would still be distributed a $0 check, which will inevitably confusion Employees and potentially lead to inconsistent reporting.

- Garnishments cannot be “edited” in an Adjustment Pay Run, just as they cannot be in the standard pay run wizard. They will still recalculate based on changes to earnings or employee disposable income.

- Pay Runs or checks that were voided cannot be adjusted

- Adjustments can be made up to the start of the current calendar year. You may not adjust pay runs from prior years.

- What this tool is: The tool is best positioned to amend the following mistakes (as well as some others not mentioned):

- Employee(s) was overpaid

- Employee(s)was paid in the wrong location

- Employee(s) was paid via incorrect earning codes

- Employee(s) were paid, and therefore taxed, against the wrong location

- Employee(s) were assigned incorrect deduction / benefit codes or deduction / benefit amounts

- Employee(s) were included in a pay run that should not have been

- What this tool is not: This tool is incredibly useful to remediate individual pay run based errors. However, it does not meet every use case. Consider the below as situations where this tool may not be the correct solution alongside the options to consider:

- Scenario: Employee(s) were underpaid or not included in a prior pay run

- Proposed Solution: Create a Special Pay Run and include the missed employees or add the additional earnings that were not included in prior runs

- Scenario: Looking to edit, remove, or add a tax that was not pulled in the original run and is NOT a result of other changes in the adjustments (i.e. location changes)

- Proposed Solution: This tool should not be used to adjust specific taxes or tax amounts. Taxes can and will change based on resulting input changes, but the tool is not meant to edit the resulting taxes into the numbers the user desired. This practice is typically advised against, but in rare scenarios the client should contact support for assistance via the Manual Transactions Tool

- Scenario: Making subject wage adjustments at quarter end

- Proposed Solution: Contact Support for assistance. The representatives can utilize the Manual Transactions Tool or request next level support assistance.

- Will I, as the reader, benefit from this feature?

- If you have a business that often receives last minute, or post pay run timesheet submissions (i.e. staffing)

- If you have complicated benefits or deductions and / or tiered models that require great attention (these setups are more prone to mistakes)

- If you have a commission-based businesses or sales models that will pay monies in advance and need to remediate later

- Who can use this feature? This will be rolled out to pilot clients for a short period. The full rollout will be dependent on received feedback or required changes. Upon request, this feature can be turned on for your workspace at any time.

- Scenario: Employee(s) were underpaid or not included in a prior pay run

Starting an Adjustment Pay Run:

The Adjustment Triage Step:

Selecting the Employees to include in the Adjustment:

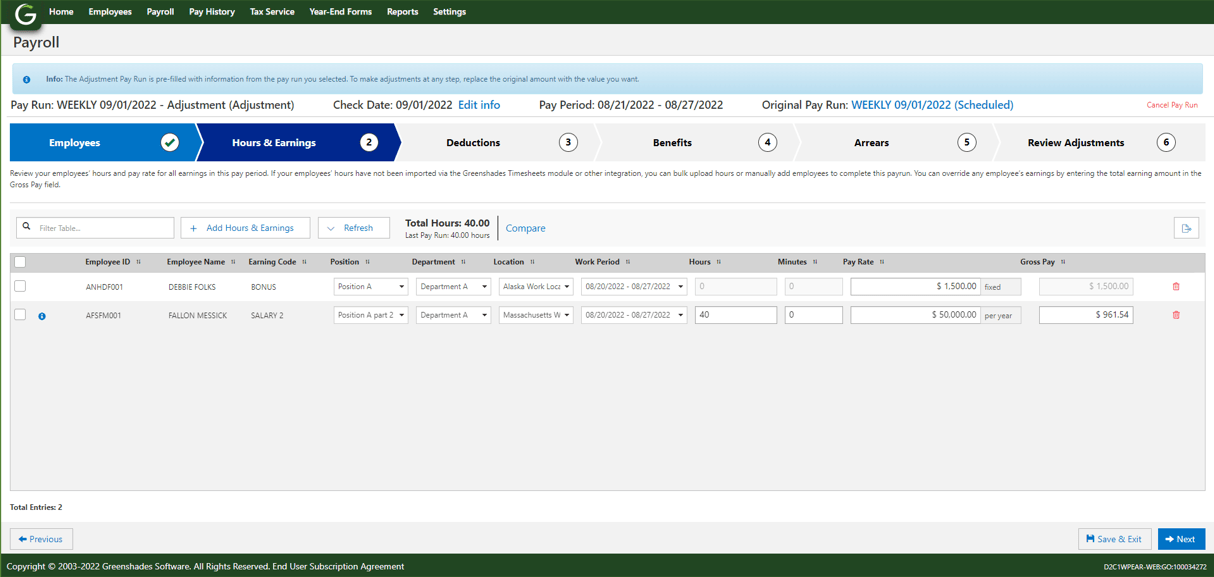

Adjustment Pay Run – Hours & Earnings Step:

Adjustment Pay Run – Review:

Navigation:

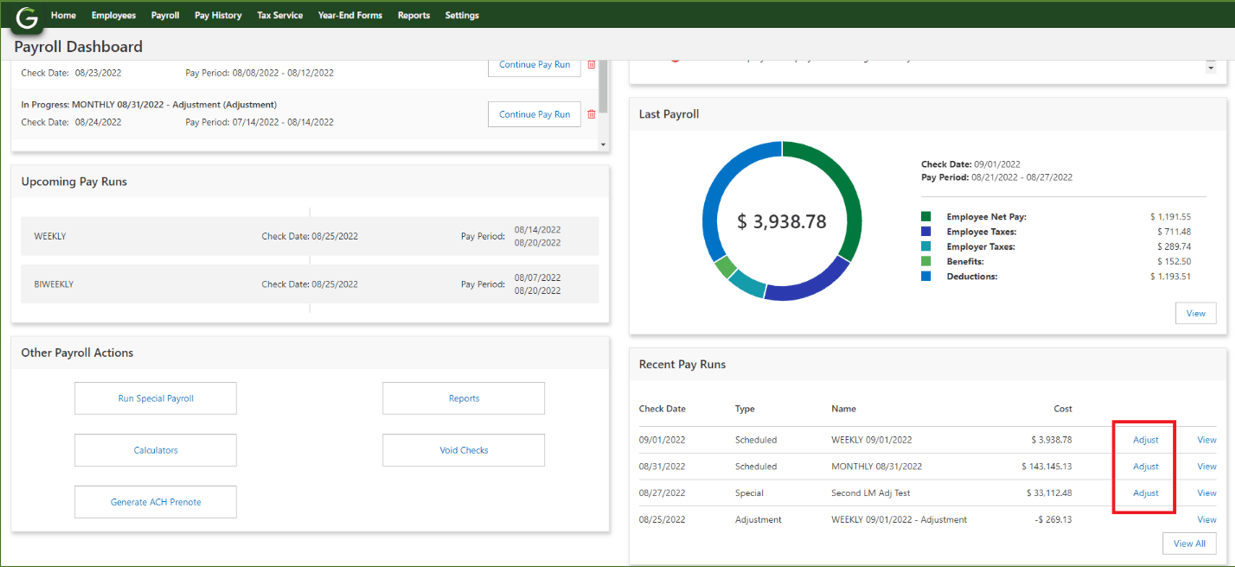

Admin Access Settings: Greenshadesonline.com > Payroll Tab >Recent Pay Runs >Adjust

Enhanced Feature – Pay Run Wizard: Combined Hours & Earnings (Initial Rollout)

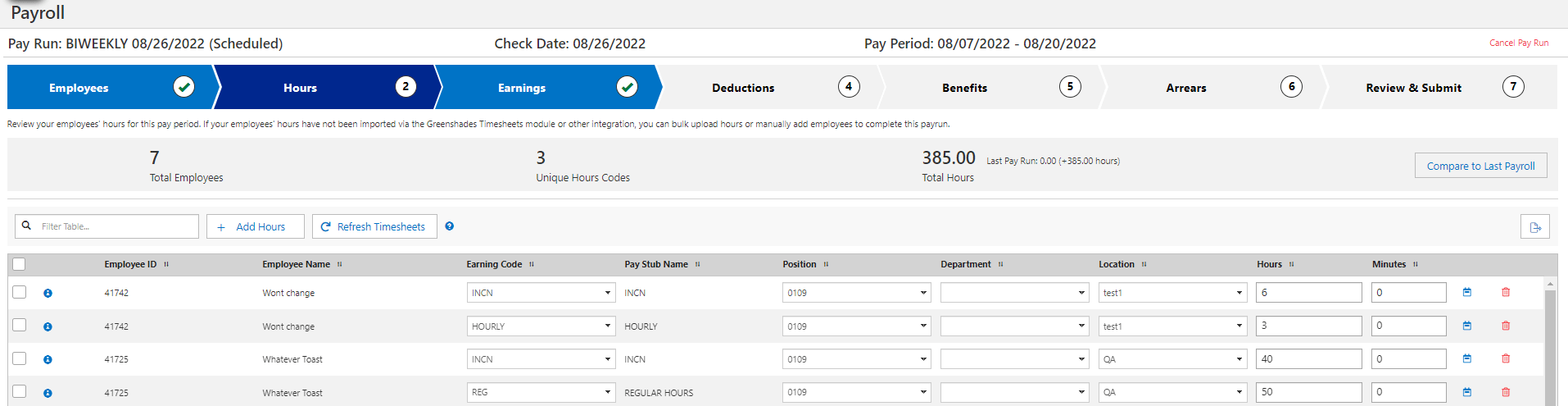

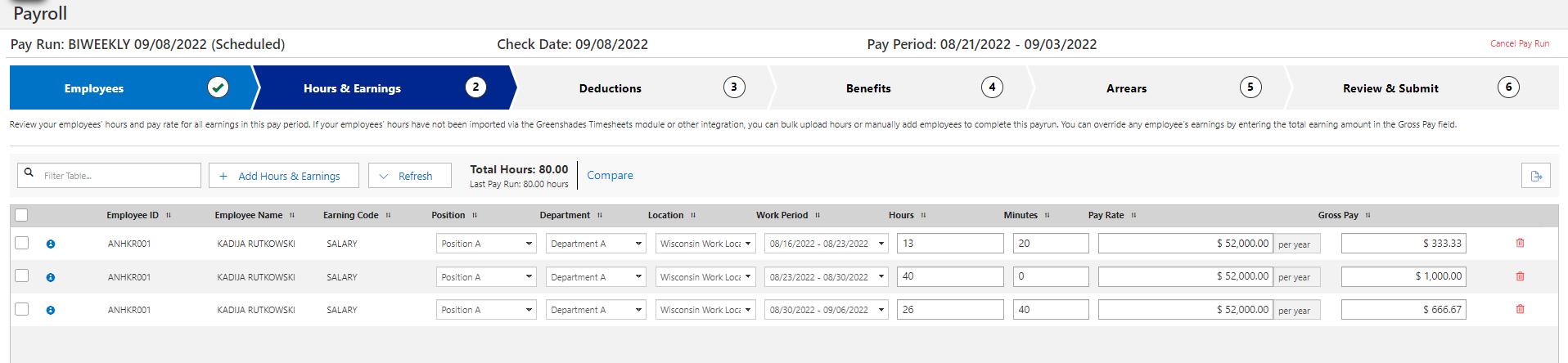

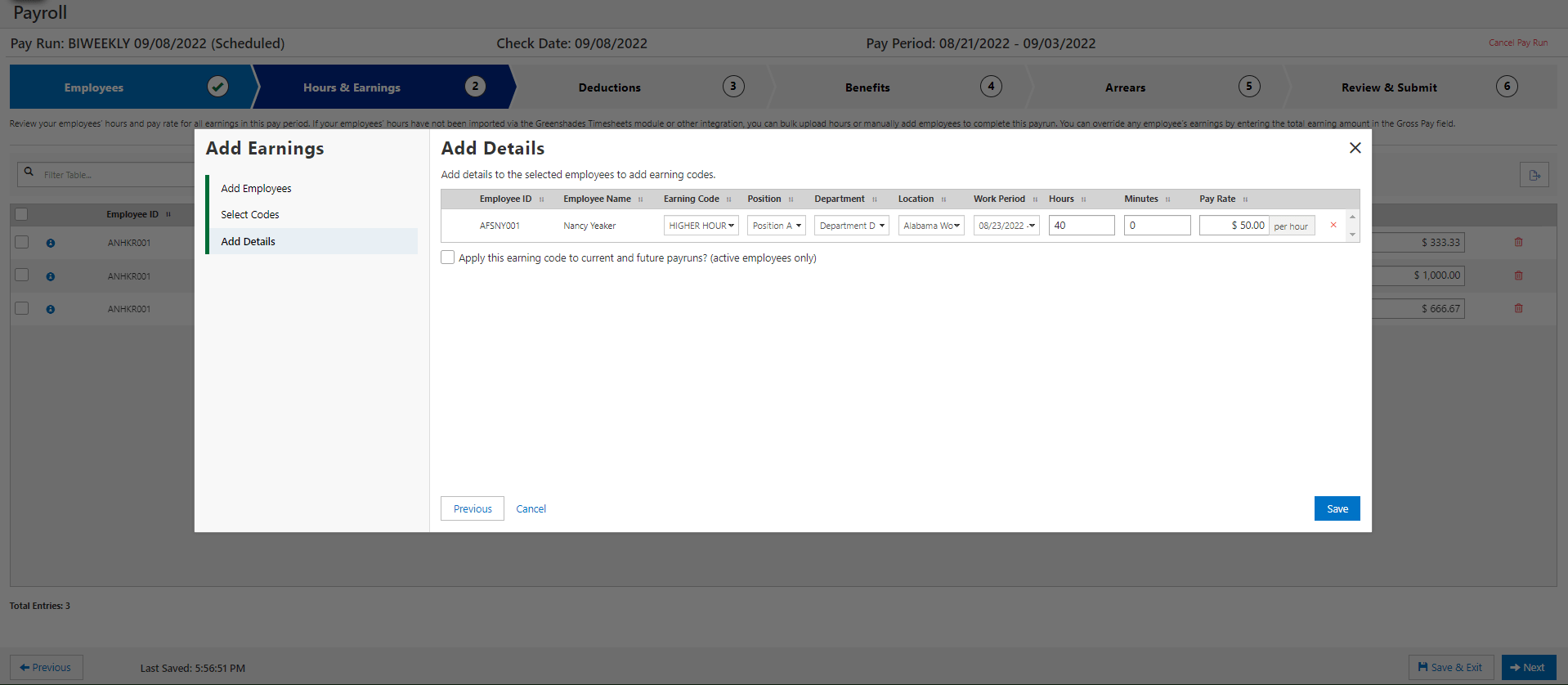

- Feature Description: With the goal of creating a more fluid and comprehensive Pay Run Experience, Greenshades has combined the Hours and Earnings stages of the Pay Run Wizard. The user interface and imports have all been updated to operate via a single page or import respectively

- Key Feature Information: This combined view will be the new standard for the product moving forward. That said, for the coming months, Greenshades will continue to support the ability to import this data in the historical format of Hours and Earnings as separate files. Once the change has gone live, if this separation is required to maintain smooth operation for your business, you may request to keep the separated import option. In addition, this change has added some other improvements found below

- Active clients that receive this combined functionality will be provided both separated and combined import options at first

- All newly onboarded clients will be provided the combined Hours & Earnings functionality / import only

- One row in the interface no longer implies one employee. Each row in the new wizard will indicate a single work week (7 days)

- The Hours compare tool has been visually reworked

- Will I, as the reader, benefit from this feature?

- All clients should benefit from this change as the new functionality will present a more fluid and straightforward management of employee hours / earnings.

- This change is specifically impactful for users looking to import a single file for Hours & Earnings or clients that are accustomed to managing this data in one place or table (common in many other HCM systems)

- Who can use this feature? This will be rolled out to pilot clients for a short period. The full rollout will be dependent on received feedback or required changes. Upon request, this feature can be turned on for your workspace at any time.

Standard Hours Step (separated from earnings):

New Hours & Earnings combination:

Adding earnings via the new Hours & Earnings combination:

Navigation:

Combined Hours & Earnings Step: Payroll Tab > Open Pay Run > Hours & Earnings

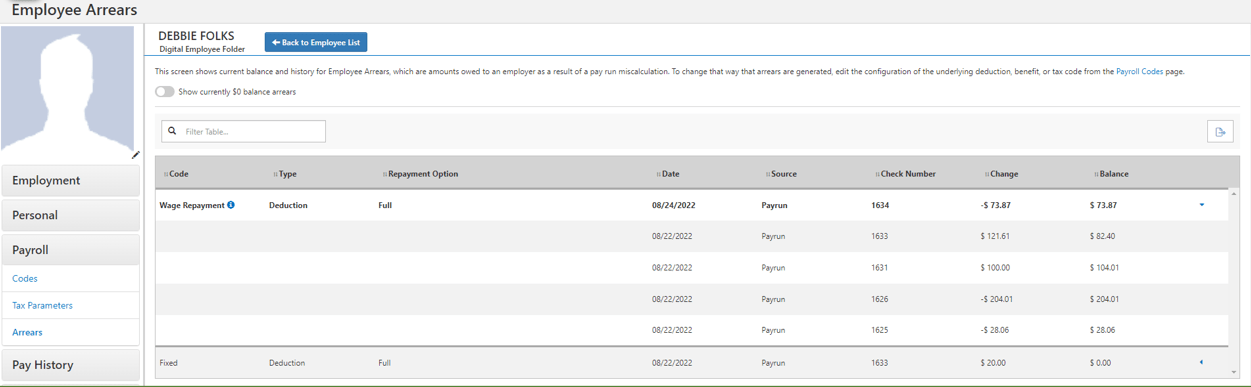

New Page – Employee Information: Payroll Arrears Page (Initial Rollout)

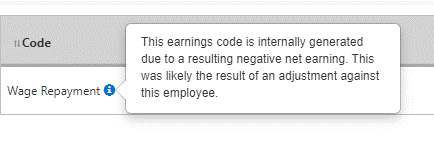

- Feature Description: A new page has been added to the employee card to view arrears balances and their history of changes. This page is for informational and viewing purposes only. Its need is primarily a result of the Wage Repayment Arrears that will surface via negative net earnings submitted by an Adjustment Pay Run.

- Key Feature Information: This page accessible at a per employee view. As a result, this page will not replace arrears reports for the purpose of reviewing arrears across the entire Workspace / Company.

- Will I, as the reader, benefit from this feature? All clients can benefit from this page since it is not a change to functionality, but a new page that will assist in making arrear information more visible and well understood

- Who can use this feature? This will be rolled out to pilot clients for a short period. The full rollout will be dependent on received feedback or required changes. Upon request, this feature can be turned on for your workspace at any time.

New Arrears Page:

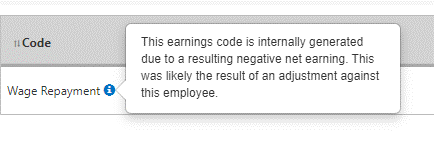

Wage Repayment Help Text:

Navigation:

Payroll Arrears Page: Greenshadesonline.com > Employees Tab > Select an Employee > Payroll > Arrears

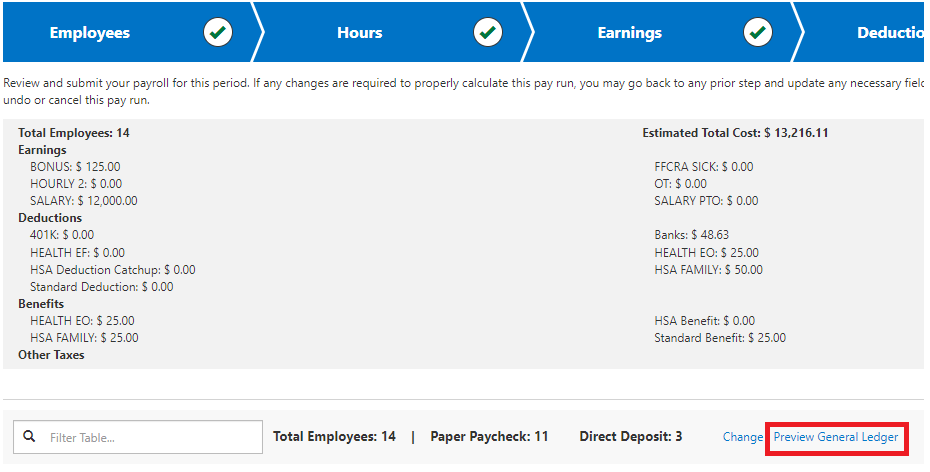

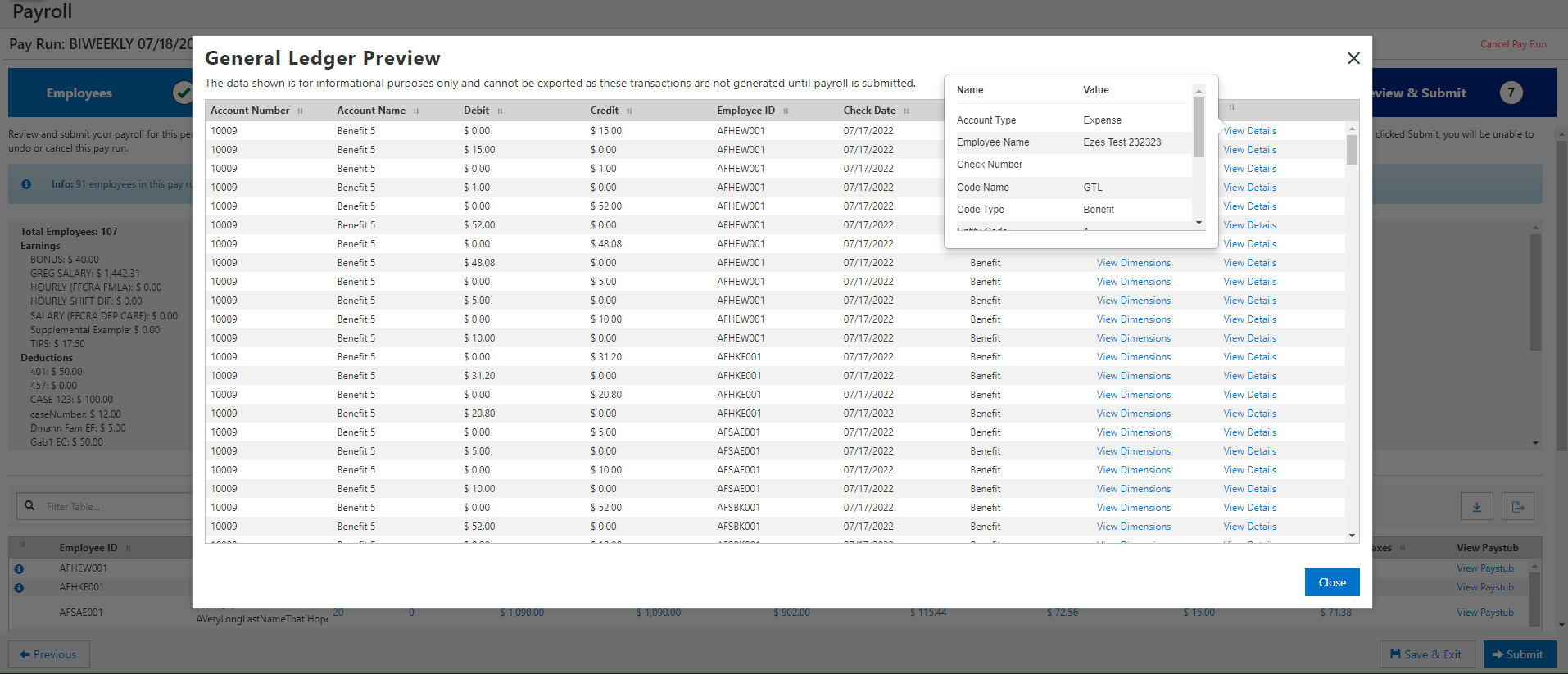

New Feature – Pay Run Wizard: Show GL Preview at the Review and Submit step

- Feature Description: A new option has been added to the Review and Submit step of the Pay Run wizard to allow users to see the GL transactions that will be produced from completing the current Pay Run. Clicking the link Labeled “Preview General Ledger” will present users with all pending GL transactions so that they can review and confirm that the transactions data, as well as their current account mappings, are correct before submitting the Pay Run.

- Key Feature Information: Note that there is intentionally no ability to download or export this information since these transactions have NOT actually occurred until after payroll submission. Exporting this data before actual creation would lead to falsified and incorrect accounting.

- Will I, as the reader, benefit from this feature? All clients that Utilize the Greenshades General Ledger post pay run can and should benefit from this feature. It is advised for your practitioner to review these transactions before the submission of every pay run

- Who can use this feature? This feature is live for all clients

Accessing the General Ledger Preview:

The General Ledger Preview:

Navigation:

General Ledger Preview: Greenshadesonline.com > Payroll > Open Pay Run >Review & Submit >Preview General Ledger