Release – 7/27/22

Greenshades Online Payroll

New Feature – New Admin Access Level: Limited Payroll Admins

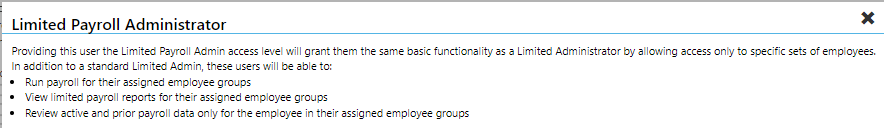

- Feature Description: A new admin level, known as a Limited Payroll Admin, will provide the user the ability to manage and run payroll in a restricted format for only their assigned subset of employees. These Admins are limited, which by Greenshades definition, indicates that they will not have access to change larger workspace level settings or view the information of employees outside of their assignment. The assignment of specific employees will be at a group level, which is defined by a variety of category options (i.e. department, position, location, etc.).

- Limited Payroll Admin access to each module of Greenshades Online:

- Setting controls:

- Will not have access to workspace level control settings (i.e. Company information and Access Settings)

- Will not be able to change workspace level Payroll settings (i.e. code settings, GL mappings, Schedule settings)

- Will be able to configure certain employee settings for employees that they manage

- Will be able to manage notifications

- Setting controls:

- Employee controls:

- Will be able to edit personal and employment information about employees that they have been given access to

- Will not be able to add or remove employees

- Will be able to manage employee level code controls for employees that they have access to

- Will be able to manage other HR functions, however these modules access can be refined during the admin setup

- Payroll controls:

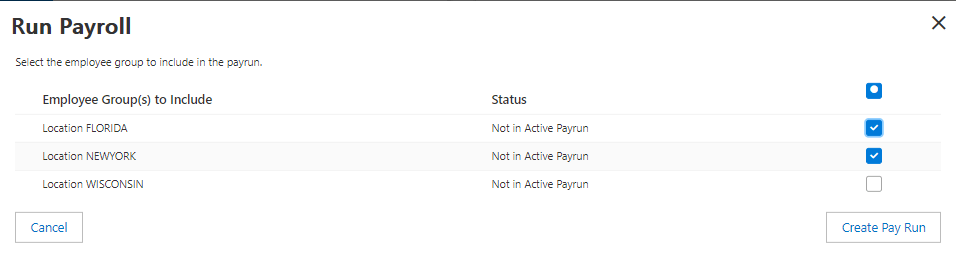

- Will be able to create scheduled, special or adjustment level pay runs for all employees that they have been given access to

- Will not be able to create pay runs for employees outside of their access

- Will only possess the ability to operate current and / or completed pay runs where they have access to all the employee groups in the run at minimum

- Will not possess the ability to operate current and / or completed pay runs where they have access to only specific employees from that run

- Will only possess the ability to void checks for employees that their employee group has given them access to

- Will only possess the ability to Generate ACH files, print pay registers, and perform other post pay run actions for employees that their employee group has given them access to

- Will only see payroll errors in the “Warnings Requiring Your Attention” widget for employees that their employee group has given them access to

- Reporting controls:

- Will be able to run payroll reporting for all employees that they have access to, even if they did not personally run the pay run that produced those results

- Will not be able to report on, or see the data, of employees that they do not have access to, even if their employees shared a run with other employees outside of their control

- Who will benefit from this feature?

-

- Payroll clients that need split their pay runs across multiple practitioners.

- Payroll clients that want to run confidential payrolls.

- Payroll clients that would like to restrict their payroll practitioners from accessing higher level functions (i.e. settings, quarterly reports, and more)

- Who can use this feature? This will be rolled out to early access clients for a short period. The full rollout will be dependent on received feedback or required changes. Upon request, this feature can be turned on for your workspace at any time.

Defining Limited Payroll Admins:

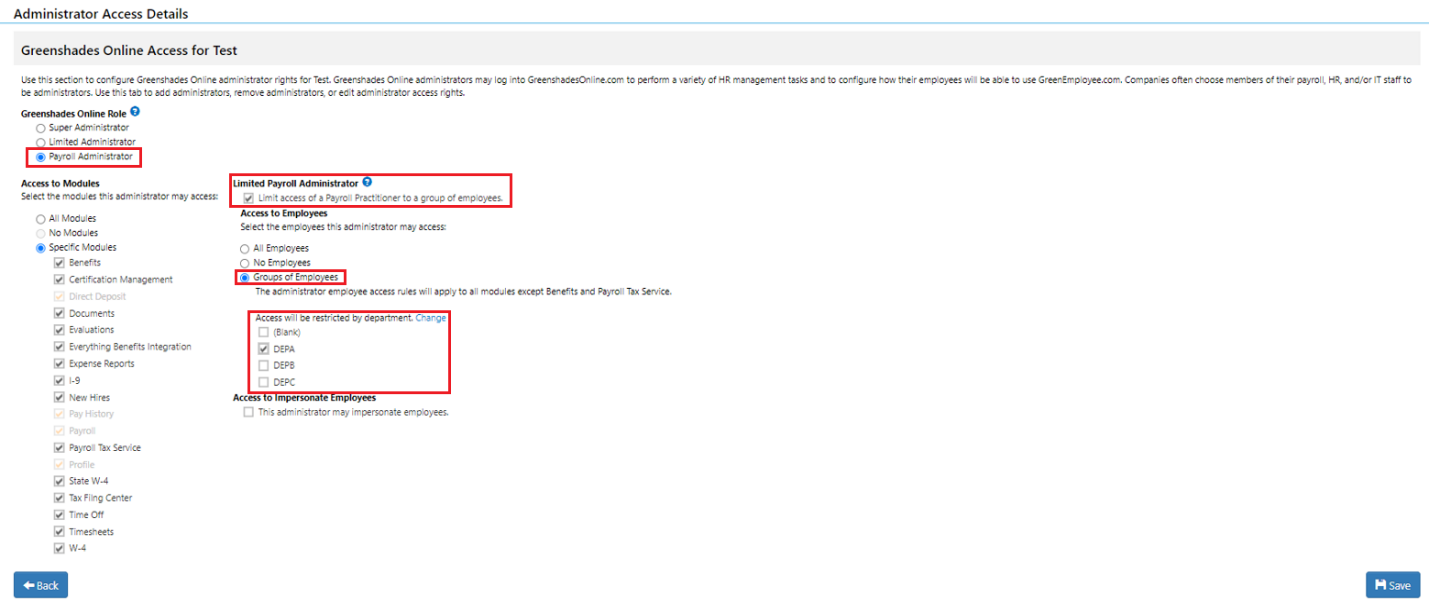

Limited Payroll Admin Setup:

Creating a Pay Run as a Limited Payroll Admin:

Comparing limited and non-limited admins:

|

|

Payroll Administrator |

Limited Payroll Administrator |

|

Payroll: Active / completed Pay Runs and Reports |

Full access to all Employees |

Granted full access for associated groups |

|

Payroll: Process, submit, review, report on, file ACH, deposit checks against, and maintain the general ledger pay runs |

Full access to all Employees |

Limited access to managed Employees |

|

Employee Tab: Payroll Codes and Tax Parameters |

Full access to all Employees |

Limited access to managed Employees |

|

Workspace Settings: Company Info |

Full Access |

Not Applicable |

|

Workspace Settings: Employee, Tax, and Notification options |

Changes affect all employees |

Settings options will be determined by the enabled modules Limited access to managed Employees when module is available |

|

Workspace Settings: Payroll Settings (i.e. code management, general ledger mapping, and schedule management) |

All HR and Payroll level settings |

Not Applicable |

Navigation:

Admin Access Settings: Greenshadesonline.com > Settings > Access Settings > Administrator Access > Access Control > Add / Edit Administrator

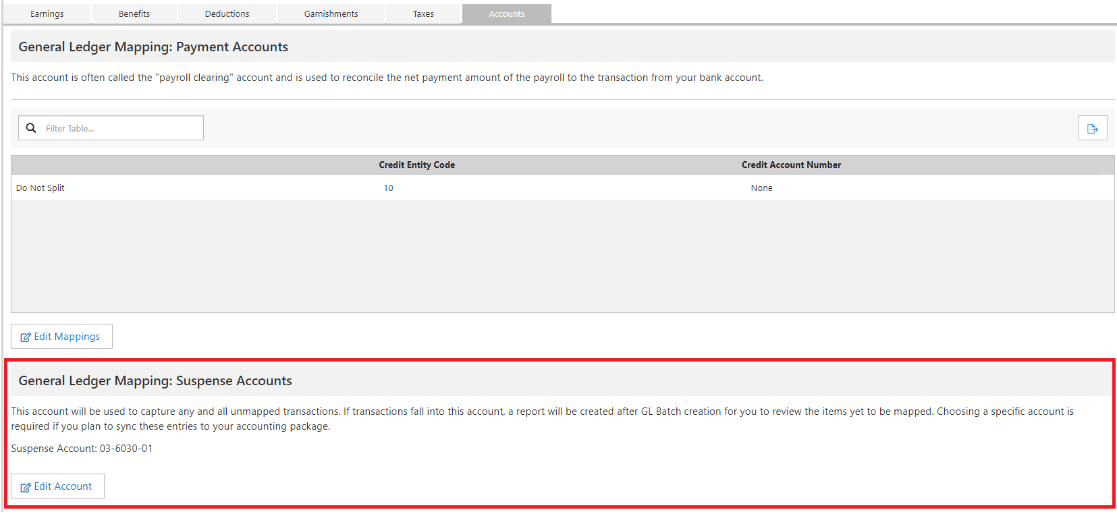

New Feature – General Ledger: Suspense Accounts

- Feature Description: As a payroll practitioner or accountant, setting up your General Ledger to be correctly mapped and balanced is an incredibly important function. When a payroll is completed, and it’s generated General Ledger batch reveals an unbalance set of transactions between debits and credits, it is very likely that something is wrong with your GL setup / mapping assignments. Previously, in the Greenshades GL functionality, there was no clear way to understand which transactions caused this to happen. To assist clients that run into these scenarios, a new General Ledger Feature and account type known as a “Suspense Account” has been added to the GL offering. This account works essentially as a “lost transactions” It will be used to collect all GL transactions that did not fall into another account as defined by the users GL mappings. This new account will also be accompanied by the new “Suspense Transactions Details” report that will show the users each of the transactions that fell into the Suspense account and therefore were not for in other mappings.

- Key Takeaways:

- Moving forward your general ledger will never have a batch that results in different Debits and Credits since all unmapped transactions will now fall into the suspense account.

- You will now have a standard function and reviewable reported of all unmapped transactions through their Suspense Account.

- You will not be required to assign an actual ledger account against the new suspense account. However, completing this process is highly recommended. If utilizing our syncing products, you will not be able to “Sync” transactions that fell into the Suspense account unless you have assigned a ledger Account. Failing to do so will restrict syncing as long as these unmapped transactions exist.

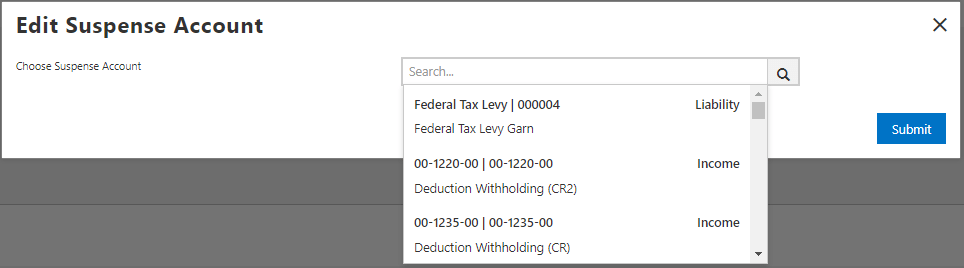

Suspense Account – Account assignment:

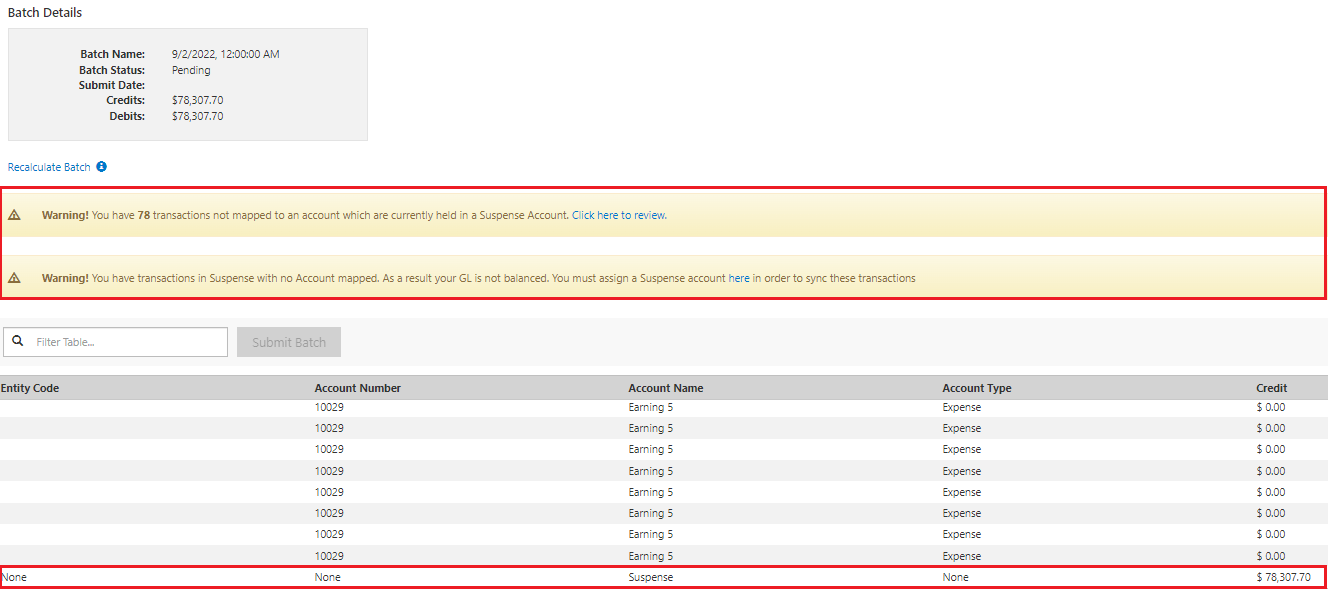

Reviewing Suspense Account transactions in Post Pay Batch review:

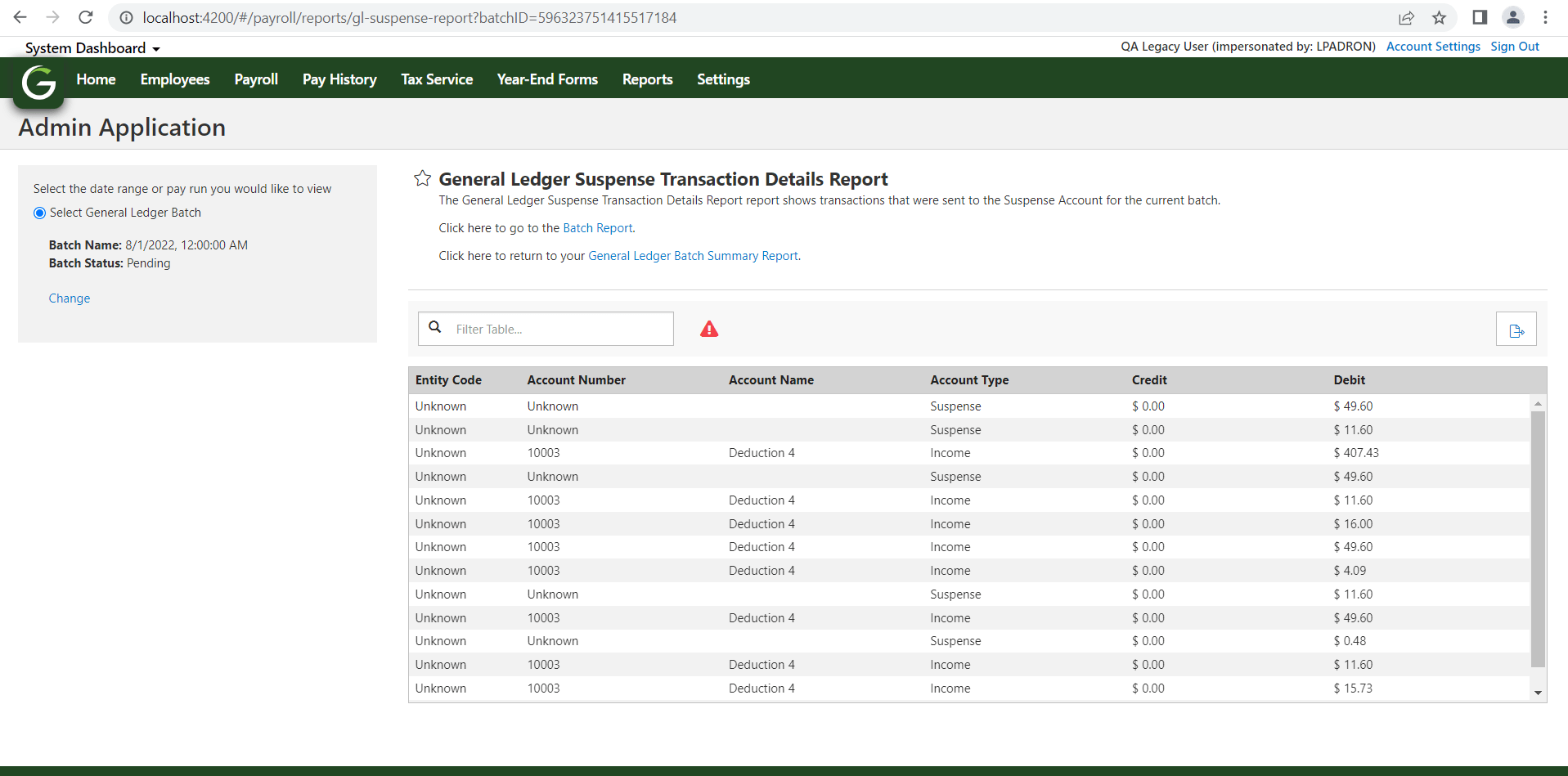

Suspense Account Transactions Details Report:

Navigation:

Suspense Account Assignment: Greenshadesonline.com > Settings > Payroll > General Ledger > Accounts > General Ledger Mapping: Suspense Accounts

General Ledger Batch Review: Greenshadesonline.com > Payroll > View Prior Pay Run > Review Batch (under the General Ledger Section)

Suspense Account Report: Greenshadesonline.com > Reports > Suspense Account Transactions Details Report

Enhanced Feature – General Ledger: Improved Text

- Background: General Ledger setup can be a complicated process for clients. Knowing this, we stated looking for areas to improve the information we provide in the product. We understand that contextual descriptions and warnings are important and can help you through the process.

- What’s new? Small information changes are being to the General Ledger screens to help better guide clients through the General Ledger mapping process. The released changes are as follows:

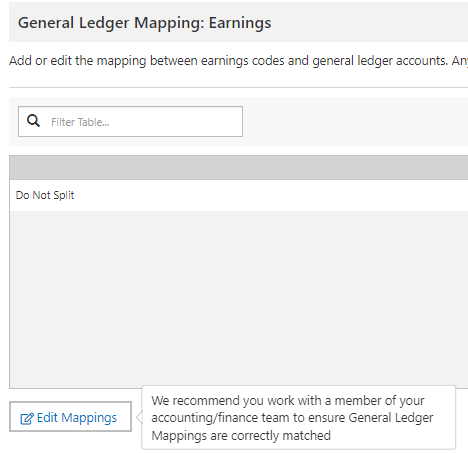

- The General Ledger informational banner has been revised to better explain the mapping process

2. The “Edit Mappings” button will notify the user of its functionality upon hover over

Navigation:

General Ledger Mapping Screens: Greenshadesonline.com > Settings > Payroll > General Ledger

New Feature – Employee Direct Deposit: Branch On / Off Setting

- Background: All employees of clients that utilize our direct deposit module currently have access to our Branch integration. This enables an employee to instantly setup a Branch account and connect it as a Greenshades DD account through only a few clicks. Once the account is created the employee will have access to a free digital bank and the ability to receive funds up to 2 days faster than standard DD.

We understand that some of our clients would like to control their employee’s access to the Branch integration. This could be due to other third party partnerships, misunderstanding of the Branch offering, or other unknown factors to Greenshades.

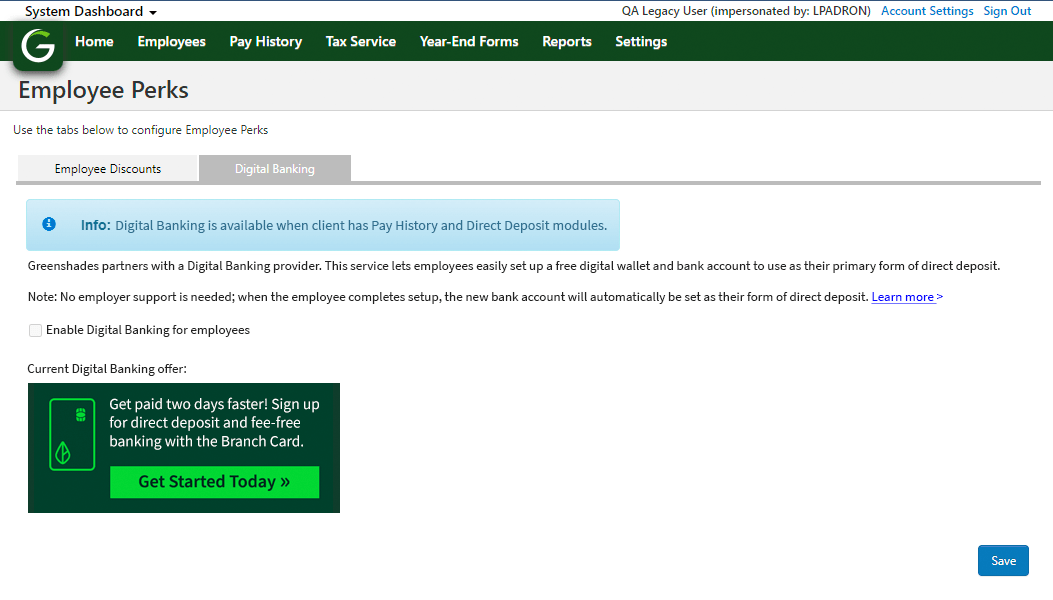

- What’s new? To empower our employers with the desired control over the offerings presented to their employees, a workspace level setting has been added to the Employee Perks settings as a new tab called “Digital Banking”. Here you will have the ability to:

- Turn the Branch integration on or off for all employees at anytime

- Clients can Learn More about Branch and what the integration can offer for your employees

New Digital Banking Settings:

Navigation:

Setting to turn Branch on or off: Greenshadesonline.com > Settings > Employee Service > Employee Perks > Digital Banking

Changed Feature – Code Transitions: Locking down the ability to change “Tax Types” and “Wage Types”

- Background: At any time, in the code settings for creation or edits of a code, as an admin you may choose the taxation rules for that code via the “Tax Type” and “Wage Type” options. These options will control the taxation methods for Deductions / Benefits or Earnings codes respectively. After initial creation and actual use of those codes, that setting could be edited at any time. Unfortunately, making that change after prior payrolls have been executed could cause a variety of unintended issues, such as:

- For new payrolls, this changed tax or wage type could affect resulting withholdings or subject wages

- For historical reporting, the changed types will create strange totals at the code level, especially when filing tax forms such as 941s

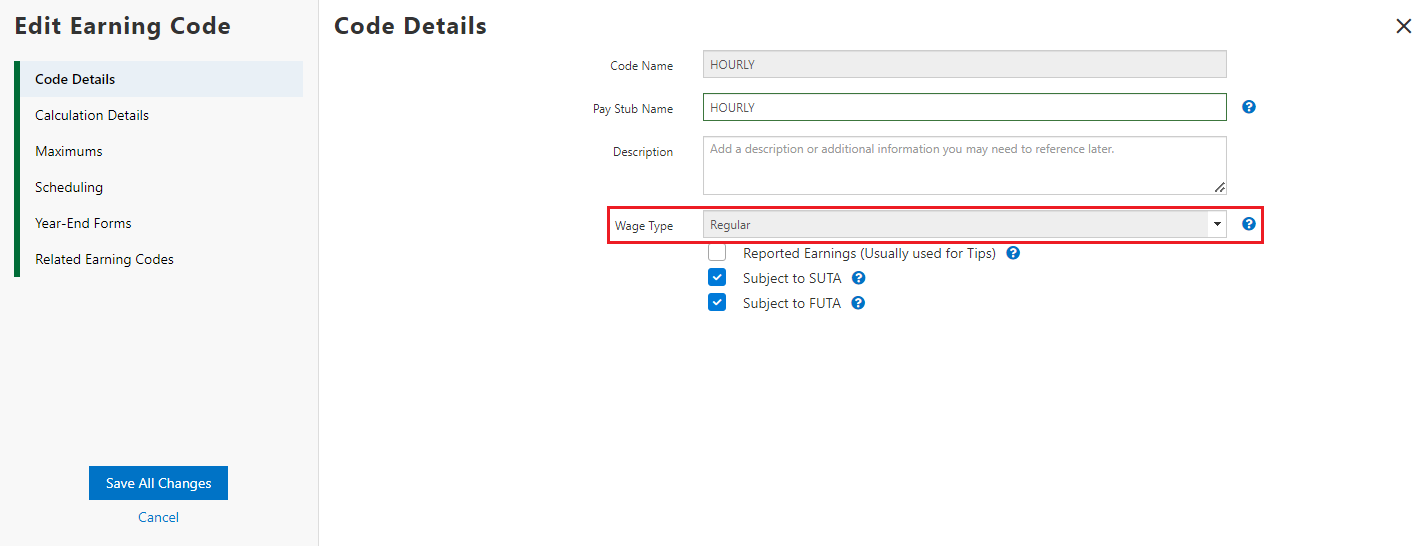

- What Changed? To protect clients from creating unintended historical taxation confusion, both the “Tax Type” and “Wage Type” options will be restricted from editing after that code has been utilized in a submitted payroll.

- Key things to note:

- Codes, and therefore the use of them as they pertain to employees, will always maintain their history

- You may freely edit wage or tax types on a code until a payroll has been ran that utilized said code

- If you require different taxations or code setups, it is advised to create or remove codes to fit the requirements instead of editing current code taxation related settings. This is the best practice to avoid the aforementioned issues.

Earnings Code Wage Type (restricted from edit):

Navigation:

Code Setup Screens: Greenshadesonline.com > Settings > Payroll > Codes > Earnings / Deductions / Benefits Tabs > Add / Edit Code

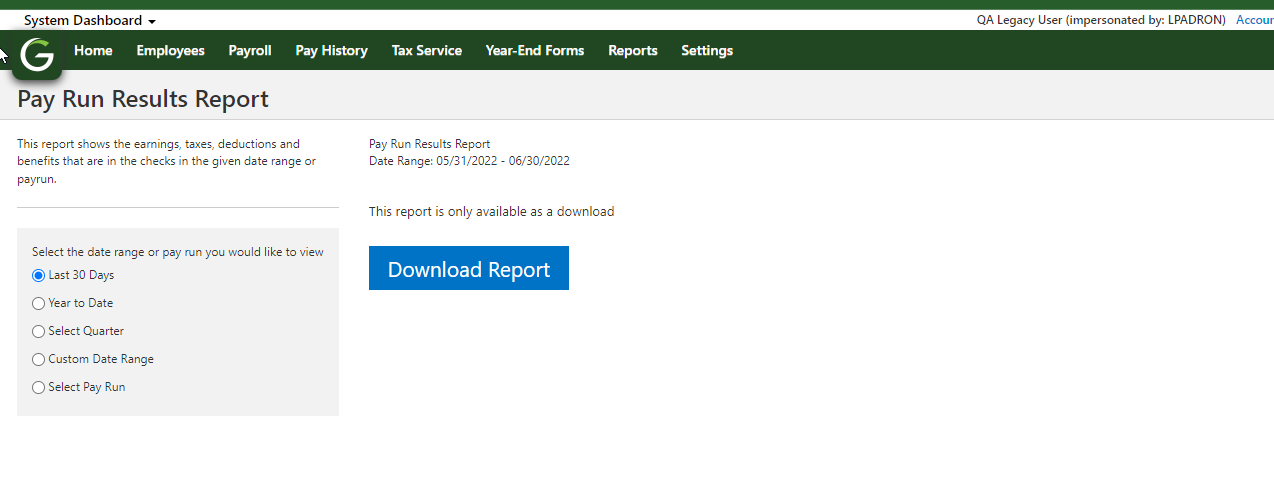

Changed Feature – Pay Run Results Report: Changed to a download only report

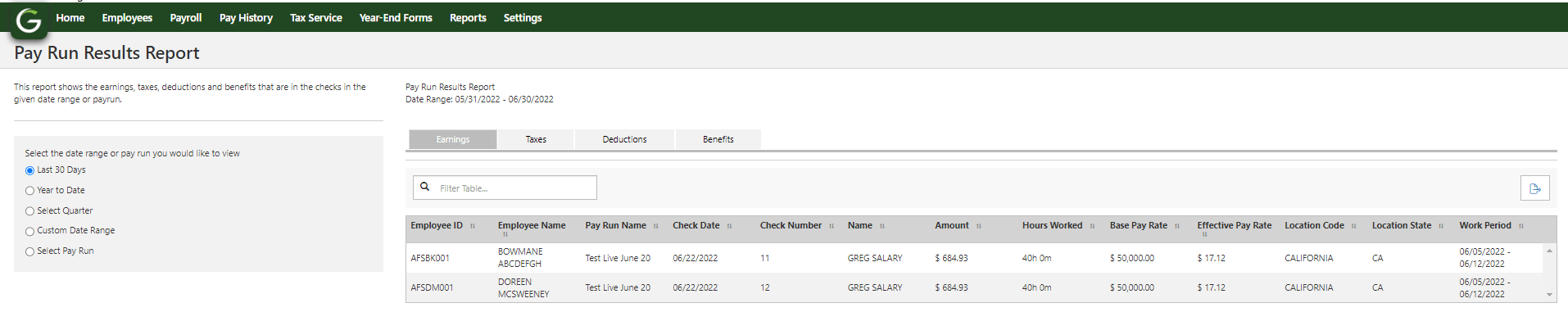

- Background: The Pay Run results contains all data at a detailed level for a single pay run or collection of pay runs over the chosen period. This report generated all this data into a navigable table in the product. You could review the information in the product or choose to download it and analyze separately. Unfortunately, the functionality of allowing this data to be displayed in the product was very slow and would occasionally fail to ever produce the results, especially for very large sets of data.

- What Changed? Due to performance concerns, we will be changing this report to be a download only version and it will no longer show the data in the product. This change facilitates the ability for all payroll clients to properly utilize the Pay Run Results report whenever required.

Old Pay Run Results Report:

New Pay Run Results Report:

Navigation:

Code Setup Screens: Greenshadesonline.com > Settings > Payroll > Codes > Earnings / Deductions / Benefits Tabs > Add / Edit Code