Anticipated Release – 6/1/22

Greenshades Online Payroll

Enhanced Feature – General Ledger: Recalculate GL batch improvements

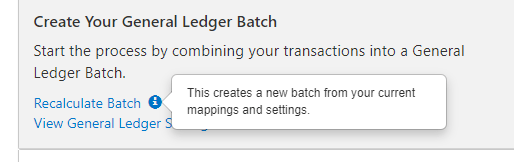

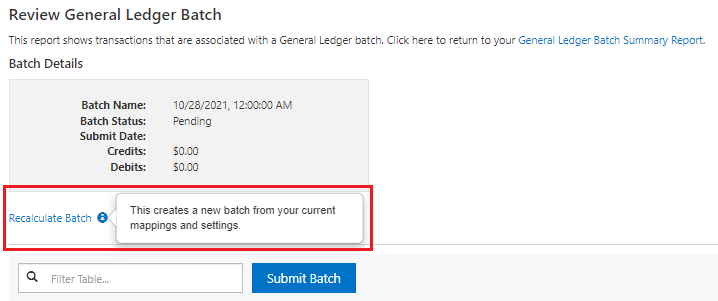

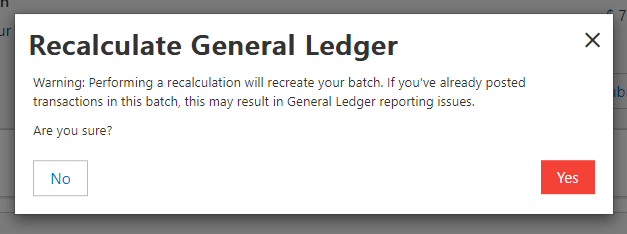

- Summary: The recalculate General Ledger functionality was not shown in enough areas of the UI. Moreover, it’s functionality was not well enough articulated to users.

- Changed items in the User Interface:

- Add the feature to the Batch Review Page

- Add info text next to the feature’s action button

- A warning pop-up is shown to users after clicking the function to ensure they understand how this could impact transactions that were already imported or synced prior

Post Pay Run Screen (updated Recalculate batch function):

Batch Review Screen (newly added Recalculate batch function):

Informational Warning before submitting a recalculate:

Navigation:

General Ledger Post Pay Run Screen:Greenshadesonline.com > View Pay Run > (scroll) “Submit Transactions to the General Ledger” section

General Ledger Batch Review Screen: Greenshadesonline.com > View Pay Run > (scroll) “Submit Transactions to the General Ledger” section > Review Batch

New Feature – Benefit / Deduction Code Setup: Catch-up Support

- Previously: Greenshades payroll did not formally support catch-up contributions with proper tax shielding via a standard in product code setup for benefits or deduction codes.

- Today: The product now fully supports the process to add and apply catch-up codes for all relevant Tax Types (see list below):

- Traditional 401k

- Roth 401k

- HSA (single and family)

- 403(b)

- Roth 403(b)

- Simple IRA

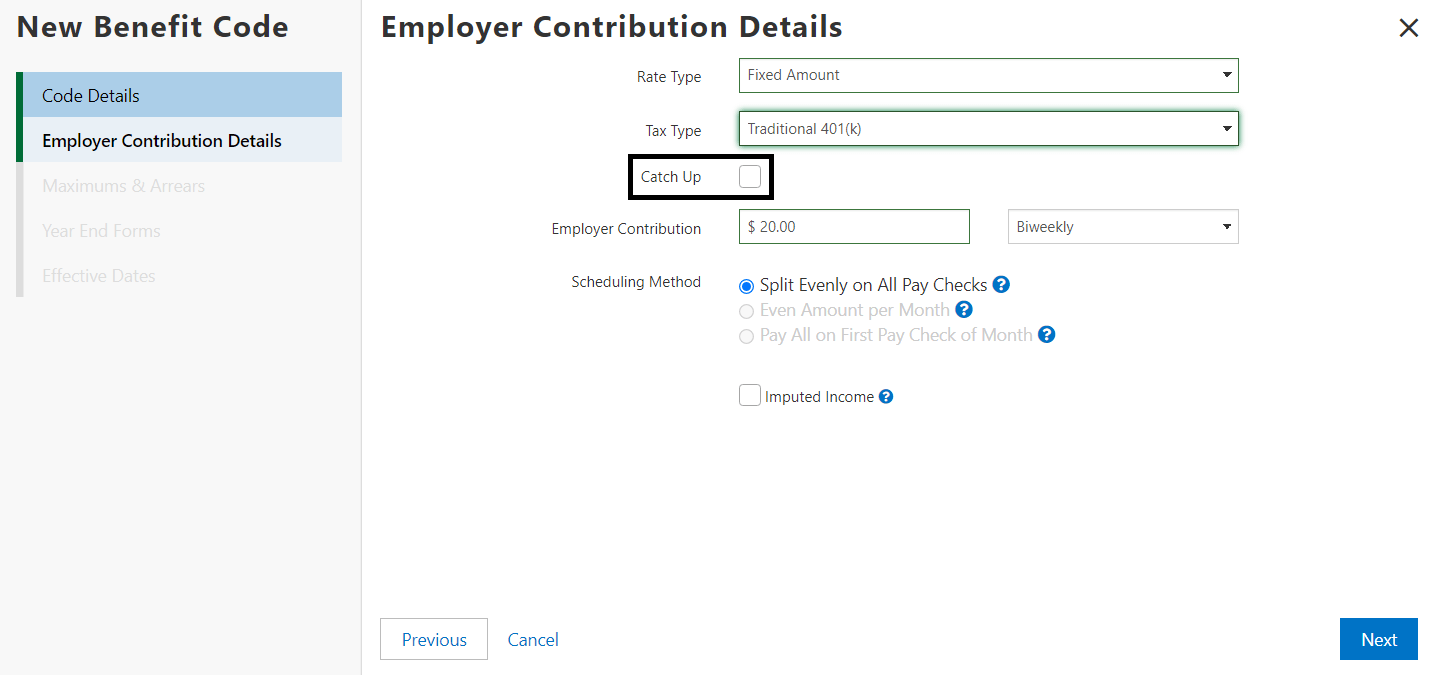

Catch-up code checkbox in code setup:

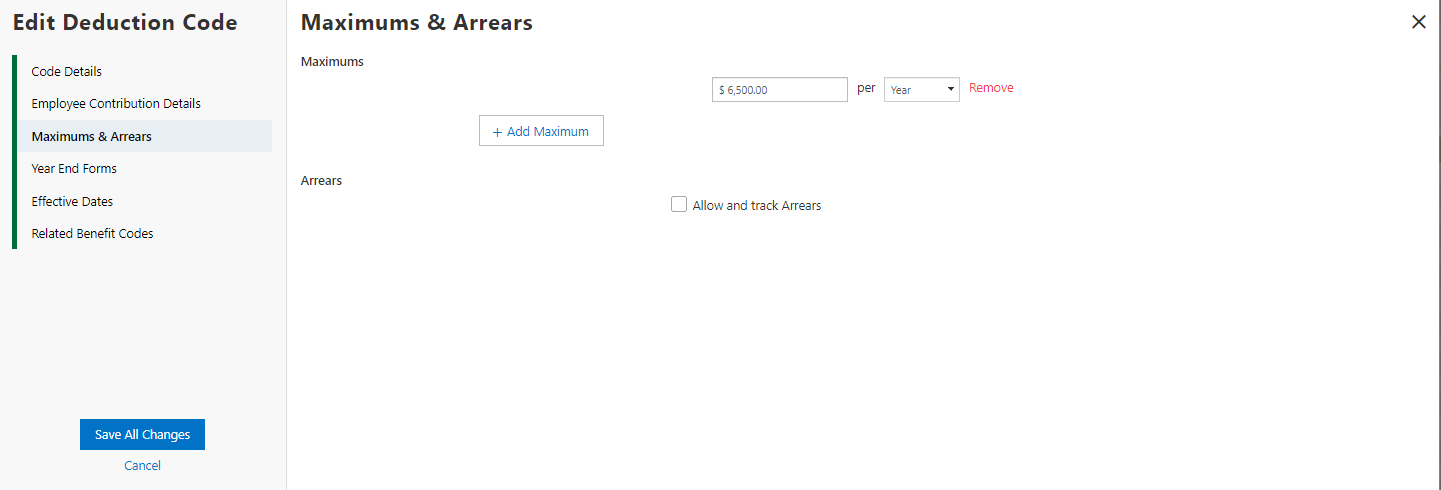

Setting up Catch-up Maximum:

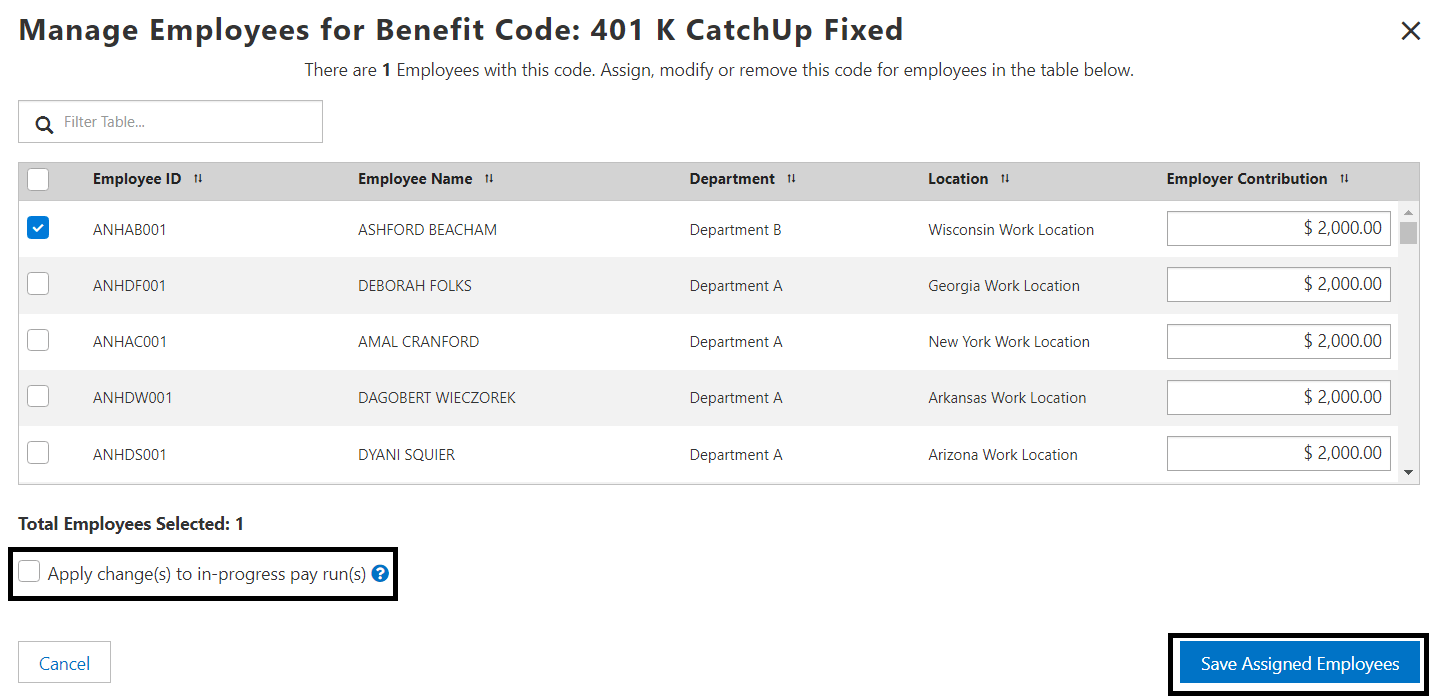

Assigning Employees to the Catch-up codes:

Navigation:

Build Catch-up Codes: Greenshadesonline.com > Settings > Payroll > Deduction / Benefit Codes > New / Edit Code

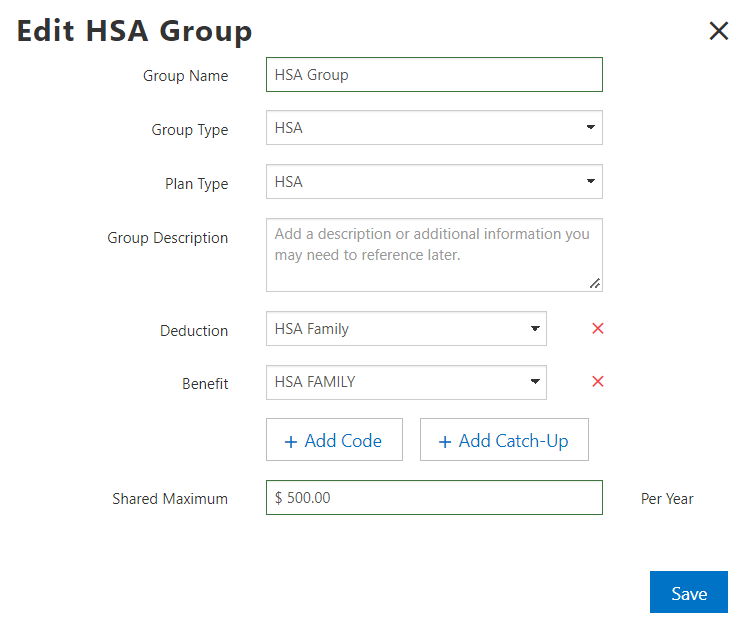

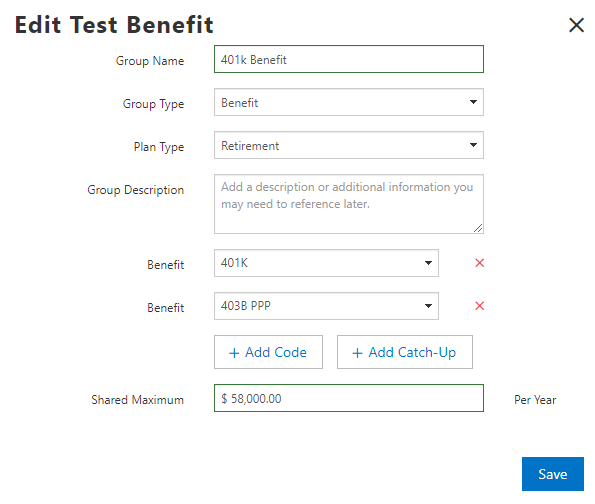

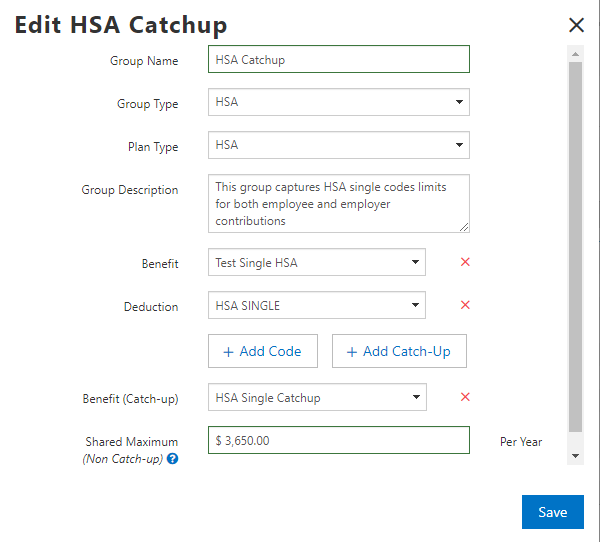

Enhanced Feature – Benefit / Deduction Code Setup: New Shared Code Group functionality

- Previously: Shared Code Groups were a rarely used and misunderstood feature that supported a small selection of use cases. The most important of these, was to combine maximum amount limits on a selection of different retirement codes to ensure employees did not exceed the IRS limits when contributing to multiple plan types.

- Today: With the addition of catch-up codes, the use cases for these groups, as well as their necessity to be utilized, grew greatly. The above use case is still valid, but more importantly these groups are REQUIRED for users to facilitate automatic transitioning of employees from their base retirement or HSA codes to their catch-up contribution codes after reaching base limits.

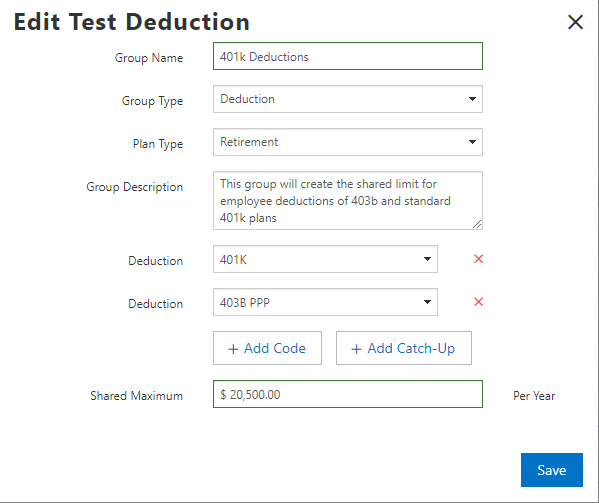

- The below images portray great examples of how you may want to utilize these setups for your employees

- Terminology Reference:

- Group Name: This is just an identifier for the user to reference. Nothing downstream will be impacted by this name.

- Group Type: Use this to select the types of codes that can be applied to this group. The list includes the option of Benefit, Deductions, custom, or HSA. The HSA option is used to allow limits to be equally shared between benefits and deduction types.

- Plan Type: This selection will choose the focus of the group, essentially as “Retirement”, “HSA”, or a custom type called “Other”

- Group Description: This description is a way for the user to recall the specific purpose of that group. As an example, “This group will create the shared limit for employee deductions of Roth and standard 401k plans”

- Code selections: Apply the relevant Deduction and Benefit codes to the group. Consider that these selectable codes will be filtered based on your above setup selections. Only codes related to the selected Group Type and Plan Type will be shown in the creation process.

- Catch-up Code selections: Catch-ups will appear separately in the Catch-ups menu of the Shared Code Group window only when they are applicable.

- Shared Maximums: This is where your combined maximum between the codes in the group will be defined. For something like retirement contributions, these are often straightforward as defined by the IRS that year. In the case of a Retirement deduction group setup, it would almost always simply be the employee contribution limit for that year (Ex. $20,500 in 2022).

- Please consult with Greenshades support for additional details or questions on how to properly setup and manage Shared Code Groups

Shared Code Groups (Retirement Example):

Shared Code Groups (HSA Examples):

Navigation:

Build Shared Code Groups: Greenshadesonline.com > Settings > Payroll > Shared Code Groups

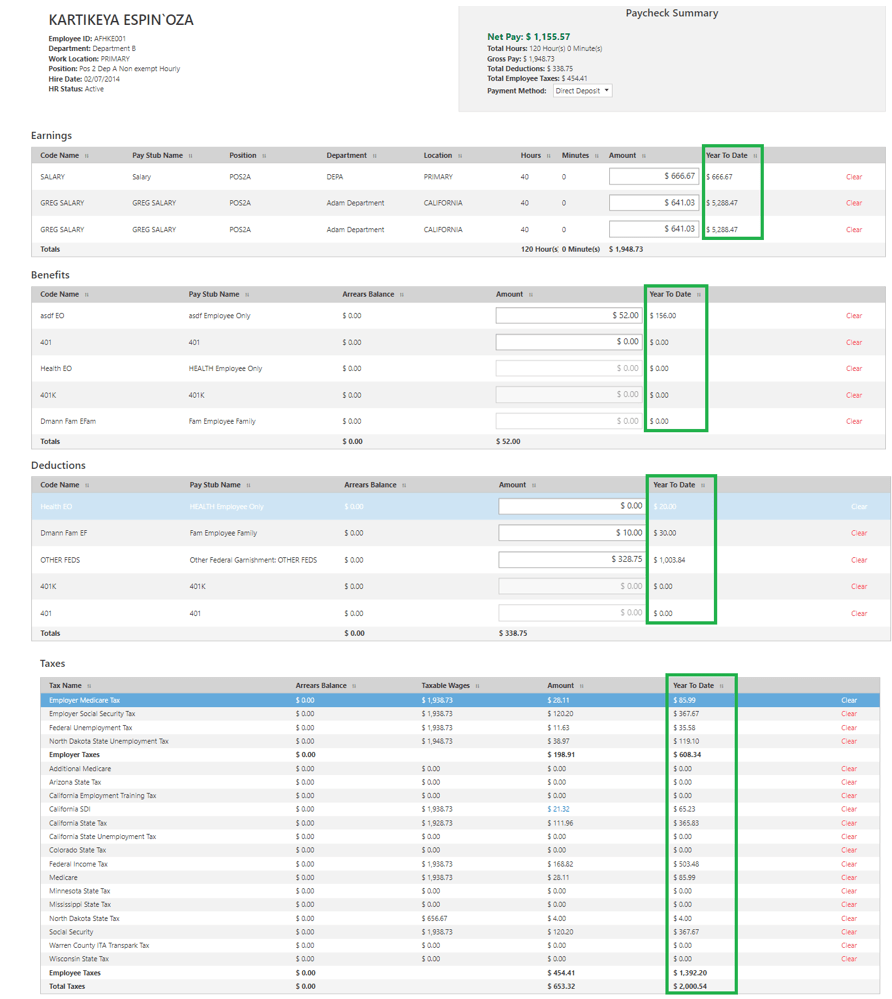

Enhanced Feature – Pay Run Wizard: Visual improvements to the Pay Stub review screen

- Previously: The “Benefit” and “Deduction” sections of the Pay Stub review were lacking YTD accrued amounts. Moreover, the way information was displayed in the “Taxes” section was hard to properly read the column totals and YTD amounts.

- Today: These issues have been addressed in two ways. First, YTD accrued amounts have been added to the “Benefit” and “Deduction” sections. Secondarily, the “Taxes” section UI has been reimagined to read more clearly to the user.

New Pay Stub Review Screen:

Navigation:

Pay Run Wizard: Greenshadesonline.com > Payroll > Start / Continue Pay Run > Review and Submit Step > View pay stub

Past Updates