|

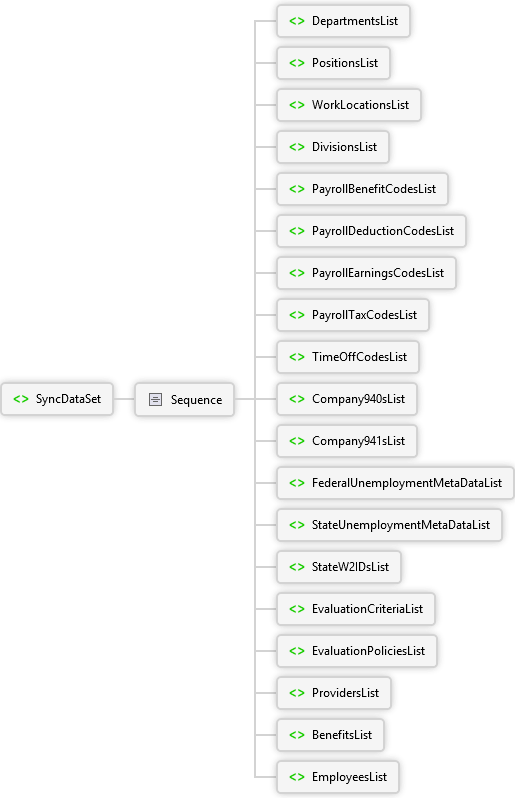

Sequence

|

|

Sequence

|

|

Sequence

|

LocationID xs:string

Unique identifier for work location

|

|

Address1 xs:string

Physical location - address line 1

|

|

Address2 xs:string

Physical location - address line 2

|

|

Address3 xs:string

Physical location - address line 3

|

|

City xs:string

Physical location - city

|

|

County xs:string

Physical location - county

|

|

PostalCode xs:string

Physical location - five- or nine-digit ZIP code

|

|

Country xs:string

Physical location - country

|

|

Phone1 xs:string

Location's primary phone

|

|

Phone2 xs:string

Location's alternate phone

|

|

Phone3 xs:string

Location's second alternate phone

|

|

Fax xs:string

Location's fax number

|

|

|

|

|

|

|

|

|

Sequence

|

|

Sequence

|

BenefitCodeID xs:string

Stores the unique identifier to a specific benefit

|

|

BeginDate xs:dateTime

The effective date for this benefit, if applicable

|

|

EndDate xs:dateTime

The ending date for this deduction, if applicable

|

|

Active xs:boolean

Indicates whether this benefit is active or not

|

|

Taxable xs:boolean

Indicates whether this benefit is subject to taxation

|

|

SubjectToMedicare xs:boolean

Indicates whether this benefit is subject to FICA Medicare tax

|

|

SubjectToFuta xs:boolean

Indicates whether this benefit is subject to federal unemployment tax

|

|

SubjectToSuta xs:boolean

Indicates whether this benefit is subject to state unemployment tax

|

|

|

|

|

|

|

Sequence

|

|

Sequence

|

BeginDate xs:dateTime

The effective date for this deduction

|

|

EndDate xs:dateTime

The ending date for this deduction, if applicable

|

|

Active xs:boolean

Indicates whether this deduction is active or not

|

|

ShelteredFromFuta xs:boolean

Indicates whether the deduction is sheltered from federal unemployment tax

|

|

|

|

|

|

|

Sequence

|

|

Sequence

|

Type xs:string

Type of pay code

|

|

Active xs:boolean

Indicates whether the code is active

|

|

IsTaxable xs:boolean

Indicates if this earnings code is subject to taxes

|

|

IsSubjectToFUTA xs:boolean

Indicates if this earnings code is subject to federal unemployment tax

|

|

IsSubjectToSUTA xs:boolean

Indicates if this earnings code is subject to state unemployement tax

|

|

|

|

|

|

|

Sequence

|

|

Sequence

|

TaxCodeID xs:string

Unique Identifier for a specific tax; when providing Federal Income, Social Security, and Medicare tax rows, you must use FED, SS, and MED as the Code

|

|

TaxType xs:string

Stores the type of tax, e.g. Withholding, Unemployment

|

|

SubType xs:string

Stores the subtype of the tax, e.g. Employee, Employer

|

|

|

|

|

|

|

Sequence

|

|

Sequence

|

TimeOffCodeID xs:string

This field uniquely identifies the time off type, e.g. VAC, SCK, HOL

|

|

Description xs:string

This field describes the time off type: Vacation, Sick, Holiday

|

|

|

|

|

|

|

Sequence

|

|

Sequence

|

TotalWages xs:float

Total employee wages. This should equal FUTA Wages + RemainingWages

|

|

FUTAWages xs:float

The amount of wages which are subject to FUTA

|

|

|

|

|

|

|

Sequence

|

|

Sequence

|

QuarterEnd xs:dateTime

The quarter end date for the quarter being reported

|

|

SocialSecurityWages xs:float

Total wages and tips for the quarter eligible for social security tax

|

|

|

|

|

|

|

Sequence

|

|

Sequence

|

State xs:string

State for which there is SUTA liability

|

|

StateSutaID xs:string

Corresponding SUTA ID for each state

|

|

QuarterEnd xs:dateTime

End Date of the quarter where the rate applies

|

|

|

|

|

|

|

Sequence

|

|

|

|

Sequence

|

|

Sequence

|

EmployeeID xs:string

Stores the unique identifier of a specific employee

|

|

SupervisorEmployeeID xs:string

The Employee ID of the employee’s supervisor; should match the ID of another employee

|

|

LocationID xs:string

Unique identifier of employee’s work location; should match an ID in CompanyLocations

|

|

Active xs:boolean

1 if employee is active; 0 otherwise

|

|

Gender Restriction of xs:string

Employee gender; options are Male, Female, and Unknown

|

|

BirthDate xs:dateTime

The employee’s birthdate

|

|

|

Sequence

|

|

Sequence

|

Address1 xs:string

Physical location - address line 1

|

|

Address2 xs:string

Physical location - address line 2

|

|

Address3 xs:string

Physical location - address line 3

|

|

City xs:string

Physical location - city

|

|

State xs:string

Physical location - two-letter state abbreviation

|

|

County xs:string

Physical location - county

|

|

ZipCode xs:string

Physical location - five- or nine-digit ZIP code

|

|

Country xs:string

Country name from IRS options

|

|

Phone1 xs:string

Location phone

|

|

Phone2 xs:string

Alternate location phone

|

|

Phone3 xs:string

Alternate location phone 2

|

|

Email xs:string

Employee’s corporate email address

|

|

ForeignAddress xs:string

Indicate whether it is a foreign address or not

|

|

ForeignState xs:string

State when address is non-U.S. (e.g. a Canadian province)

|

|

ForeignPostalCode xs:string

Postal code when address is non-U.S. (e.g. a Canadian postal code)

|

|

|

|

|

|

|

|

|

Sequence

|

|

Sequence

|

SSN xs:string

Relative's Social Security Number

|

|

Gender Restriction of xs:string

Relative's gender; options are Male, Female, and Unknown

|

|

|

|

|

|

|

Sequence

|

|

|

|

|

|

|