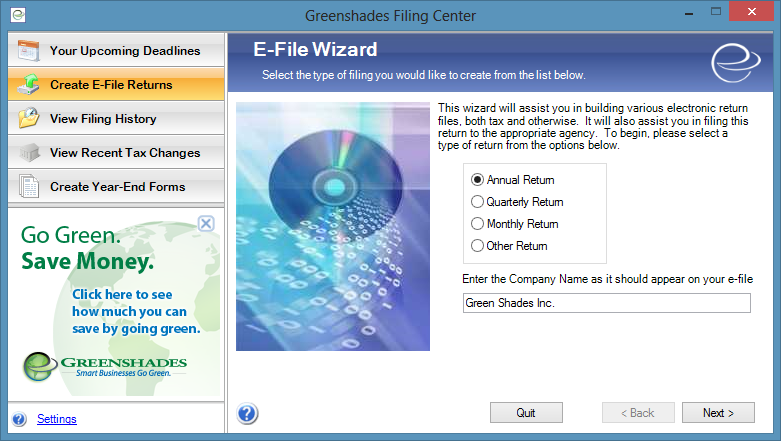

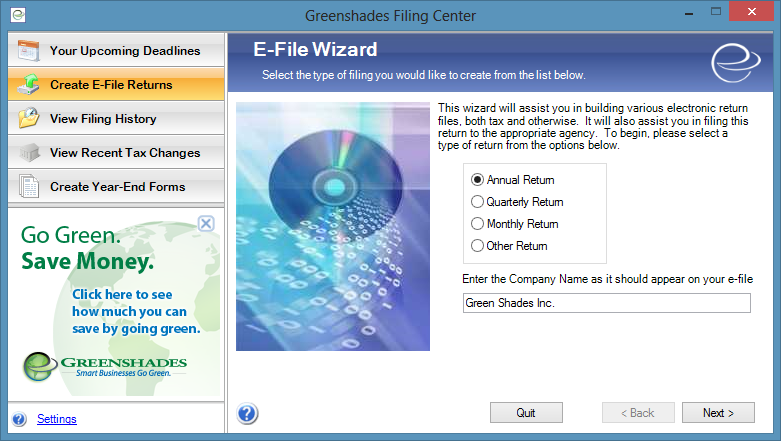

Depending on which back-office system you have, the E-File Wizard will look and

behave differently. All versions of the E-File wizard will ask you a series of questions

about what type of file, what time period of filing, and what additional

options you may want to help complete the filing. The questions will be

relevant to which ever type of filing you are trying to create. The

wizard also displays important information, such as totals, prior to the

creation of the electronic files so that you can double check with your

accounting system. Finally, the E-File Wizard will check for errors in

your data, display totals, and create the final electronic files.

To begin the E-File Wizard, choose the time period for the return you want to create.

- Annual Returns include W-2s, 1099s, and 940s.

- Quarterly Returns are for 941s, State Unemployment returns, and some local government tax returns.

- The Monthly Return category is for a specific type of local tax return in Pennsylvania governed by Act 32 as well as a Illinois Monthly Unemployment Return.

- Other Returns include a variety of other reports with custom or highly variable reporting dates, including 401(k) returns, New Hire returns, and more.

|